|

FFIEC

information technology audits

-

As a former bank examiner

with over 40 years IT audit experience, I will bring an examiner's

perspective to the FFIEC information technology audit for bankers in

Texas, New Mexico, Colorado, and Oklahoma.

For more information go

to

On-site FFIEC IT Audits.

FYI

- Company sues worker who fell for email scam - An office worker who

transferred her employer's cash to an online fraudster allegedly

ignored a warning telling her she was falling victim to a scam.

https://www.bbc.com/news/uk-scotland-glasgow-west-47135686

Gov. Newsom proposes ‘data dividend’ for Calif. consumers -

California May have some of the strictest data privacy and security

laws on the books, but Gov. Gavin Newsom has floated a “new data

dividend” that would compel Google, Facebook and the like to pay

consumers in the state who choose to share their data.

https://www.scmagazine.com/home/security-news/gov-newsom-proposes-data-dividend-for-calif-consumers/

How to build privacy for security and achieve sustained compliance -

Global and domestic privacy regulations like GDPR and the California

Consumer Privacy Act (CCPA) are forcing businesses to develop and

implement comprehensive data management processes to comply with new

privacy requirements.

https://www.scmagazine.com/home/opinion/how-to-build-privacy-for-security-and-achieve-sustained-compliance/

Israeli cyber-hotline offers help for the hacked - Israel has

launched a cyber hotline, staffed mostly by veterans of military

computing units, to enable businesses and private individuals to

report suspected hacking and receive real-time solutions.

https://www.reuters.com/article/us-cyber-israel-hotline/israeli-cyber-hotline-offers-help-for-the-hacked-idUSKCN1Q70K1

US needs an internet data privacy law, GAO tells Congress - Chief

auditor cites Facebook's Cambridge Analytica data scandal as an

example of why a privacy law is necessary.

https://www.cnet.com/news/us-needs-an-internet-data-privacy-law-gao-tells-congress/

ATTACKS, INTRUSIONS, DATA THEFT & LOSS

FYI

- Image-I-Nation supply chain breach exposes data of major credit

agencies’ customers - Image-I-Nation Technologies, Inc., which

provides hosting services and software to consumer reporting

agencies like Equifax, Experian and TransUnion, experienced a supply

chain breach that left users’ personal information exposed for as

long as two weeks.

https://www.scmagazine.com/home/security-news/image-i-nation-supply-chain-breach-exposes-data-of-major-credit-agencies-customers/

Hackers KO Malta's Bank of Valletta in attempt to nick €13m -

Hapless bank goes into lockdown mode, vanishes from the internet -

Malta's Bank of Valetta (BOV) has pulled the plug on its entire

internet access, including shutting down cashpoints and branch

offices, after detecting a "cyber intrusion" by crims that tried to

steal nearly €13m.

https://www.theregister.co.uk/2019/02/13/bank_of_valletta_13m_euro_hackers_shutdown/

Ever used VFEmail? No? Well, chances are you never will now: Hackers

wipe servers, backups in 'catastrophic' attack - A hacker wiped

every server and backup of VFEmail this week in a "catastrophic"

attack, according to the webmail service.

https://www.theregister.co.uk/2019/02/12/vfemail_hacked_wiped/

Dunn Brothers Coffee, Holiday Inn among those exposed by third-party

payment card vendor breach - A company that handles payment

operations for a large number of hotels and food establishments,

including Holiday Inn, Dunn Brothers Coffee and Zipps Sports Grill,

is informing its customers of a data breach that may have

compromised consumer’s payment card information.

https://www.scmagazine.com/home/security-news/data-breach/dunn-brothers-coffee-holiday-inn-among-those-exposed-by-third-party-payment-card-vendor-breach/

Return to the top

of the newsletter

WEB SITE COMPLIANCE -

We continue covering some of the

issues discussed in the "Risk Management Principles for Electronic

Banking" published by the Basel Committee on Bank Supervision.

Introduction

Banking organizations have been delivering electronic services to

consumers and businesses remotely for years. Electronic funds

transfer, including small payments and corporate cash management

systems, as well as publicly accessible automated machines for

currency withdrawal and retail account management, are global

fixtures. However, the increased world-wide acceptance of the

Internet as a delivery channel for banking products and services

provides new business opportunities for banks as well as service

benefits for their customers.

Continuing technological innovation and competition among existing

banking organizations and new market entrants has allowed for a much

wider array of electronic banking products and services for retail

and wholesale banking customers. These include traditional

activities such as accessing financial information, obtaining loans

and opening deposit accounts, as well as relatively new products and

services such as electronic bill payment services, personalized

financial "portals," account aggregation and business-to-business

market places and exchanges.

Notwithstanding the significant benefits of technological

innovation, the rapid development of e-banking capabilities carries

risks as well as benefits and it is important that these risks are

recognized and managed by banking institutions in a prudent manner.

These developments led the Basel Committee on Banking Supervision to

conduct a preliminary study of the risk management implications of

e-banking and e-money in 1998. This early study demonstrated a clear

need for more work in the area of e-banking risk management and that

mission was entrusted to a working group comprised of bank

supervisors and central banks, the Electronic Banking Group (EBG),

which was formed in November 1999.

The Basel Committee released the EBG's Report on risk management

and supervisory issues arising from e-banking developments in

October 2000. This Report inventoried and assessed the major risks

associated with e-banking, namely strategic risk, reputational risk,

operational risk (including security and legal risks), and credit,

market, and liquidity risks. The EBG concluded that e-banking

activities did not raise risks that were not already identified by

the previous work of the Basel Committee. However, it noted that

e-banking increase and modifies some of these traditional risks,

thereby influencing the overall risk profile of banking. In

particular, strategic risk, operational risk, and reputational risk

are certainly heightened by the rapid introduction and underlying

technological complexity of e-banking activities.

Return to

the top of the newsletter

FFIEC IT SECURITY -

We continue our series on the FFIEC

interagency Information Security Booklet.

SECURITY CONTROLS -

IMPLEMENTATION -

NETWORK ACCESS

Network security requires effective implementation of several

control mechanisms to adequately secure access to systems and data.

Financial institutions must evaluate and appropriately implement

those controls relative to the complexity of their network. Many

institutions have increasingly complex and dynamic networks stemming

from the growth of distributed computing.

Security personnel and network administrators have related but

distinct responsibilities for ensuring secure network access across

a diverse deployment of interconnecting network servers, file

servers, routers, gateways, and local and remote client

workstations. Security personnel typically lead or assist in the

development of policies, standards, and procedures, and monitor

compliance. They also lead or assist in incident-response efforts.

Network administrators implement the policies, standards, and

procedures in their day-to-day operational role.

Internally, networks can host or provide centralized access to

mission-critical applications and information, making secure access

an organizational priority. Externally, networks integrate

institution and third-party applications that grant customers and

insiders access to their financial information and Web-based

services. Financial institutions that fail to restrict access

properly expose themselves to increased transaction, reputation, and

compliance risk from threats including the theft of customer

information, data alteration, system misuse, or denial-of-service

attacks.

Return to the top of

the newsletter

NATIONAL INSTITUTE OF STANDARDS

AND TECHNOLOGY -

We continue

the series on the National Institute of Standards and Technology

(NIST) Handbook.

Chapter 19 - CRYPTOGRAPHY

19.2 Uses of Cryptography

Cryptography

is used to protect data both

inside and outside the boundaries of a computer system. Outside the

computer system, cryptography is sometimes the

only way to

protect data. While in a computer system, data is normally protected

with logical and physical access controls (perhaps supplemented by

cryptography). However, when in transit across communications lines

or resident on someone else's computer, data cannot be protected by

the originator's logical or physical access controls. Cryptography

provides a solution by protecting data even when the data is no

longer in the control of the originator. Cryptography

is used to protect data both

inside and outside the boundaries of a computer system. Outside the

computer system, cryptography is sometimes the

only way to

protect data. While in a computer system, data is normally protected

with logical and physical access controls (perhaps supplemented by

cryptography). However, when in transit across communications lines

or resident on someone else's computer, data cannot be protected by

the originator's logical or physical access controls. Cryptography

provides a solution by protecting data even when the data is no

longer in the control of the originator.

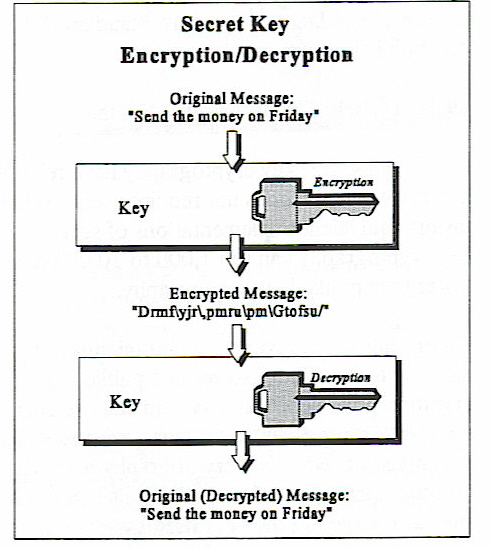

19.2.1 Data Encryption

One of the best ways

to obtain cost-effective data confidentiality is through the use of

encryption. Encryption transforms intelligible data, called

plaintext, into

an unintelligible form, called

ciphertext. This process is reversed

through the process of decryption. Once data is encrypted, the

ciphertext does not have to be protected against disclosure.

However, if ciphertext is modified, it will not decrypt correctly.

Both secret key and public key cryptography can

be used for data encryption although not all public key algorithms

provide for data encryption.

To use a secret key algorithm, data is encrypted

using a key. The same key must be used to decrypt the data.

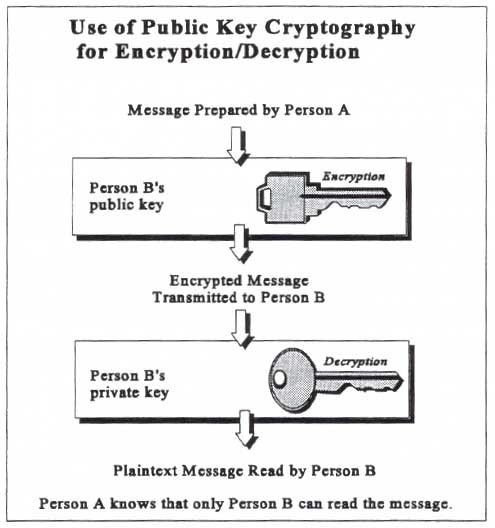

When

public key cryptography is used for encryption, any party may use

any other party's public key to encrypt a message; however, only the

party with the corresponding private key can decrypt, and thus read,

the message. When

public key cryptography is used for encryption, any party may use

any other party's public key to encrypt a message; however, only the

party with the corresponding private key can decrypt, and thus read,

the message.

Since secret key encryption is typically much

faster, it is normally used for encrypting larger amounts of data.

19.2.2 Integrity

In computer systems,

it is not always possible for humans to scan information to

determine if data has been erased, added, or modified. Even if

scanning were possible, the individual may have no way of knowing

what the correct data should be. For example, "do" may be changed to

"do not," or $1,000 may be changed to $10,000. It is therefore

desirable to have an automated means of detecting

both intentional

and unintentional modifications of data.

While error detecting codes have long been used

in communications protocols (e.g., parity bits), these are more

effective in detecting (and correcting) unintentional modifications.

They can be defeated by adversaries. Cryptography can effectively

detect both intentional and unintentional modification; however,

cryptography does not protect files from being modified. Both secret

key and public key cryptography can be used to ensure integrity.

Although newer public key methods may offer more flexibility than

the older secret key method, secret key integrity verification

systems have been successfully integrated into many applications.

When secret key

cryptography is used, a message authentication code (MAC) is

calculated from and appended to the data. To verify that the data

has not been modified at a later time, any party with access to the

correct secret key can recalculate the MAC. The new MAC is compared

with the original MAC, and if they are identical, the verifier has

confidence that the data has not been modified by an unauthorized

party. FIPS 113, Computer Data

Authentication, specifies a standard

technique for calculating a MAC for integrity verification.

Public key cryptography verifies integrity

by using of public key signatures and secure hashes. A secure hash

algorithm is used to create a message digest. The message digest,

called a hash, is a short form of the message that

changes if the message is modified. The hash is then signed with a

private key. Anyone can recalculate the hash and use the

corresponding public key to verify the integrity of the message.

|