|

FFIEC

information technology audits

-

As a former bank examiner

with over 40 years IT audit experience, I will bring an examiner's

perspective to the FFIEC information technology audit for bankers in

Texas, New Mexico, Colorado, and Oklahoma.

For more information go

to

On-site FFIEC IT Audits.

FYI

- DHS warns against ‘password spray’ brute force attacks - The DHS

recently issued a warning against the use of common and or easily

guessed passwords after several government agencies have been

targeted by “password spray” attacks.

https://www.scmagazine.com/home/security-news/cybercrime/the-dhs-recently-issued-a-warning-against-the-use-of-common-and-or-easily-guessed-passwords-after-several-government-agencies-have-been-targeted-by-password-spray-attacks/

The Strange Journey of an NSA Zero-Day—Into Multiple Enemies' Hands

- The notion of a so-called zero-day vulnerability in software is

supposed to mean, by definition, that it's secret. The term refers

to a hackable flaw in code that the software's maker doesn't know

about but that a hacker does—in some cases offering that hacker a

powerful, stealthy skeleton key into the hearts of millions of

computers.

https://www.wired.com/story/nsa-zero-day-symantec-buckeye-china/

Key to success: Tenants finally get physical keys after suing

landlords for fitting Bluetooth smart-lock to front door - Big Apple

residents weren't too appy with apartment block's high-tech security

system - Updated The owners of a Manhattan apartment block have

agreed to give their tenants mechanical keys to end a court battle

over a keyless smart-lock system.

https://www.theregister.co.uk/2019/05/08/ny_judge_mechanical_key/

Wargaming cannot take the place of real cyber protection - It’s no

big secret: cyberattacks keep business leaders up at night. In a

World Economic Forum executive study in November, cyberattacks were

rated as the fifth biggest risk to businesses worldwide, one place

behind cybercrime and fraud, and the number one business risk in the

U.S.

https://www.scmagazine.com/home/opinion/executive-insight/war-gaming-cannot-take-the-place-of-real-cyber-protection/

Baltimore will not pay ransomware demand: Mayor Young - Newly minted

Baltimore Mayor Bernard Young said the city has no intention of

paying the ransom demand set by the cyberattackers who have locked

up a large portion of the city’s servers with Robbinhood ransomware.

https://www.scmagazine.com/home/security-news/ransomware/baltimore-will-not-pay-ransomware-demand-mayor-young/

Equifax data breach recovery costs pass $1 billion - In Equifax’s

latest Security and Exchange Commission filing the company is

estimating it has spent about $1.4 billion recovering from its 2017

data breach that exposed the PII of 148 million customers, according

to a published report.

https://www.scmagazine.com/home/security-news/data-breach/equifax-data-breach-recovery-costs-pass-1-billion/

Why Rewards for Loyal Spenders Are ‘a Honey Pot for Hackers’ - The

punch cards stuffed in your wallet know next to nothing about you,

except maybe how many frozen yogurts you still need to buy to get a

free one.

https://www.nytimes.com/2019/05/11/business/rewards-loyalty-program-fraud-security.html

Offline and in the dark: Inside the CCH outage - Wolters Kluwer NV

makes the software on which many of the world’s small and midsized

accounting firms run. Early last week, a cyberattack took down that

software and presented a case study in how not to communicate with

customers over a hack.

https://www.accountingtoday.com/articles/a-massive-accounting-hack-kept-clients-offline-and-in-the-dark

IRS extends tax filing deadline following attack on Wolters Kluwer

CCH cloud accounting service - The United States Internal Revenue

Service (IRS) has approved a seven-day extension for filings that

were affected by the downtime last week of Wolters Kluwer’s CCH

accounting service, following the discovery of malware.

https://www.grahamcluley.com/irs-extends-tax-filing-deadline-following-attack-on-wolters-kluwer-cch-cloud-accounting-service/

ATTACKS, INTRUSIONS, DATA THEFT & LOSS

FYI

- Wolters Kluwer still down from May 6 cyberattack - The information

services firm Wolters Kluwer has been battling to recover from a

cyberattack that forced the company to shut down many of its tax and

accounting software applications, which is causing issues for those

using the affected products.

https://www.scmagazine.com/home/security-news/malware/wolters-kluwer-still-down-from-may-6-cyberattack/

https://www.theregister.co.uk/2019/05/08/cch_hit_by_malware/

Amazon hackers stole funds from merchant accounts - Hackers stole

funds from approximately Amazon.com Inc. Seller Central merchant

accounts during a six-month period in 2018.

https://www.scmagazine.com/home/security-news/amazon-hackers-stole-funds-from-merchant-accounts/

Hackers hold 275M records on Indian citizens for ransom after

removing them from open database - One week after a researcher

revealed a publicly configured database exposing more than 275

million sensitive records on Indian citizens, a hacking group

removed that data and replaced it with an apparent ransom note.

https://www.scmagazine.com/home/security-news/hackers-hold-275m-records-on-indian-citizens-for-ransom-after-removing-them-from-open-database/

Report: Hackers claim compromise of four AV firms, offer source code

for sale - A high-profile hacking collective claims it compromised

the networks of four premiere U.S. anti-virus vendors, and is

offering to sell their stolen source code for $300,000, according to

researchers.

https://www.scmagazine.com/home/security-news/data-breach/report-hackers-claim-to-compromise-4-av-firms-offer-source-code-for-sale/

Indiana Pacers basketball team falls for phishing attack - The

Indiana Pacers franchise, Pacers Sports & Entertainment (PSE), fell

victim to a phishing attack which resulted in unauthorized gaining

access to emails containing personal information related to a

limited number of individuals.

https://www.scmagazine.com/home/security-news/phishing/the-indiana-pacers-franchise-pacers-sports-entertainment-pse-fell-victim-to-a-phishing-attack/

Anti-virus vendors named in Fxmsp’s alleged source code breach

respond - McAfee, Symantec and Trend Micro are reportedly the

anti-virus companies whose source code the cybercriminal group Fxmsp

claims to have stolen. Comments issued by the vendors minimized the

threat, although Trend Micro did confirm that a breach had occurred.

https://www.scmagazine.com/home/security-news/anti-virus-vendors-named-in-fxmsps-alleged-source-code-breach-respond/

Tweet may contain login credentials taken in Baltimore ransomware

attack - Baltimore’s issues stemming from a May 7 Robbinhood

ransomware attack are not only starting to impact some aspects of

the city’s economy, but the security firm Armor came across a Tweet

that may contain information gleaned from the Baltimore’s network.

https://www.scmagazine.com/home/security-news/ransomware/tweet-may-contain-login-credentials-taken-in-baltimore-ransomware-attack/

Return to the top

of the newsletter

WEB SITE COMPLIANCE -

We continue covering some of the

issues discussed in the "Risk Management Principles for Electronic

Banking" published by the Basel Committee on Bank Supervision.

Board and

Management Oversight -

Principle 5: Banks should use transaction authentication methods

that promote non-repudiation and establish accountability for

e-banking transactions.

Non-repudiation involves creating proof of the origin or

delivery of electronic information to protect the sender against

false denial by the recipient that the data has been received, or to

protect the recipient against false denial by the sender that the

data has been sent. Risk of transaction repudiation is already an

issue with conventional transactions such as credit cards or

securities transactions. However, e-banking heightens this risk

because of the difficulties of positively authenticating the

identities and authority of parties initiating transactions, the

potential for altering or hijacking electronic transactions, and the

potential for e-banking users to claim that transactions were

fraudulently altered.

To address these heightened concerns, banks need to make

reasonable efforts, commensurate with the materiality and type of

the e-banking transaction, to ensure that:

1) E-banking systems are designed to reduce the likelihood that

authorized users will initiate unintended transactions and that

customers fully understand the risks associated with any

transactions they initiate.

2) All parties to the transaction are positively authenticated

and control is maintained over the authenticated channel.

3) Financial transaction data are protected from alteration and

any alteration is detectable.

Banking organizations have begun to employ various techniques that

help establish non-repudiation and ensure confidentiality and

integrity of e-banking transactions, such as digital certificates

using public key infrastructure (PKI). A bank may issue a digital

certificate to a customer or counterparty to allow for their unique

identification/authentication and reduce the risk of transaction

repudiation. Although in some countries customers' rights to

disclaim transactions is provided in specific legal provisions,

legislation has been passed in certain national jurisdictions making

digital signatures legally enforceable. Wider global legal

acceptance of such techniques is likely as technology continues to

evolve.

Return to

the top of the newsletter

FFIEC IT SECURITY -

We continue our series on the FFIEC

interagency Information Security Booklet.

SECURITY CONTROLS -

IMPLEMENTATION -

NETWORK ACCESS

Firewall Services and Configuration

Firewalls may provide some additional services:

! Network address translation (NAT) - NAT readdresses outbound

packets to mask the internal IP addresses of the network. Untrusted

networks see a different host IP address from the actual internal

address. NAT allows an institution to hide the topology and address

schemes of its trusted network from untrusted networks.

! Dynamic host configuration protocol (DHCP) - DHCP assigns IP

addresses to machines that will be subject to the security controls

of the firewall.

! Virtual Private Network (VPN) gateways - A VPN gateway provides

an encrypted tunnel between a remote external gateway and the

internal network. Placing VPN capability on the firewall and the

remote gateway protects information from disclosure between the

gateways but not from the gateway to the terminating machines.

Placement on the firewall, however, allows the firewall to inspect

the traffic and perform access control, logging, and malicious code

scanning.

One common firewall implementation in financial institutions

hosting Internet applications is a DMZ, which is a neutral Internet

accessible zone typically separated by two firewalls. One firewall

is between the institution's private network and the DMZ and then

another firewall is between the DMZ and the outside public network.

The DMZ constitutes one logical security domain, the outside public

network is another security domain, and the institution's internal

network may be composed of one or more additional logical security

domains. An adequate and effectively managed firewall can ensure

that an institution's computer systems are not directly accessible

to any on the Internet.

Financial institutions have a variety of firewall options from

which to choose depending on the extent of Internet access and the

complexity of their network. Considerations include the ease of

firewall administration, degree of firewall monitoring support

through automated logging and log analysis, and the capability to

provide alerts for abnormal activity.

Return to the top of

the newsletter

NATIONAL INSTITUTE OF STANDARDS

AND TECHNOLOGY -

We

continue the series on the National Institute of Standards and

Technology (NIST) Handbook.

Chapter 20 -

ASSESSING AND MITIGATING THE RISKS TO A HYPOTHETICAL COMPUTER SYSTEM

(HGA)20.2.2

System Operational Authority/Ownership

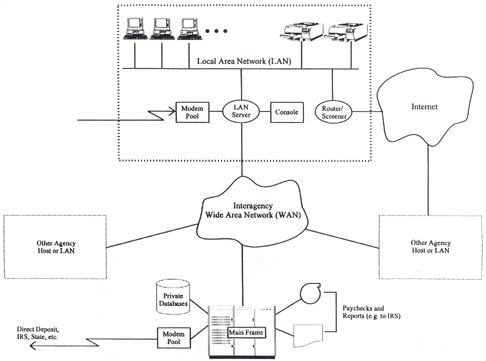

The system components

contained within the large dashed rectangle shown in the figure

below are managed and operated by an organization within HGA known

as the Computer Operations Group (COG). This group includes the PCs,

LAN, server, console, printers, modem pool, and router. The WAN is

owned and operated by a large commercial telecommunications company

that provides WAN services under a government contract. The

mainframe is owned and operated by a federal agency that acts as a

service provider for HGA and other agencies connected to the WAN.

20.2.3 System

Applications

PCs on HGA's LAN are

used for word processing, data manipulation, and other common

applications, including spreadsheet and project management tools.

Many of these tasks are concerned with data that are sensitive with

respect to confidentiality or integrity. Some of these documents and

data also need to be available in a timely manner.

The mainframe also

provides storage and retrieval services for other databases

belonging to individual agencies. For example, several agencies,

including HGA, store their personnel databases on the mainframe;

these databases contain dates of service, leave balances, salary and

W-2 information, and so forth.

In addition to their

time and attendance application, HGA's PCs and the LAN server are

used to manipulate other kinds of information that may be sensitive

with respect to confidentiality or integrity, including

personnel-related correspondence and draft contracting documents.

20.3 Threats

to HGA's Assets

Different assets of HGA

are subject to different kinds of threats. Some threats are

considered less likely than others, and the potential impact of

different threats may vary greatly. The likelihood of threats is

generally difficult to estimate accurately. Both HGA and the risk

assessment's authors have attempted to the extent possible to base

these estimates on historical data, but have also tried to

anticipate new trends stimulated by emerging technologies (e.g.,

external networks).

|