|

FFIEC

information technology audits

-

As a former bank examiner

with over 40 years IT audit experience, I will bring an examiner's

perspective to the FFIEC information technology audit for bankers in

Texas, New Mexico, Colorado, and Oklahoma.

For more information go

to

On-site FFIEC IT Audits.

FYI

- Is your organization meeting the cybersecurity “Standard of Care”?

- /CEOs and board members are increasingly under the microscope when

it comes to managing cyber risk. The financial, legal, and

regulatory impact that cyber incidents can have upon organizations

have transformed what was once an “IT problem” into a whole of

company challenge.

https://www.scmagazine.com/home/opinion/executive-insight/is-your-organization-meeting-the-cybersecurity-standard-of-care/

We ain't afraid of no 'ghost user': Infosec world tells GCHQ to

GTFO over privacy-busting proposals - Brit spies' idea would

backdoor WhatsApp et al without breaking the crypto - Bruce Schneier,

Richard Stallman and a host of western tech companies including

Microsoft and WhatsApp are pushing back hard against GCHQ proposals

that to add a "ghost user" to encrypted messaging services.

https://www.theregister.co.uk/2019/05/30/tech_hits_back_at_gchq_ghost_user_privacy_buster/

CEO who sold encrypted phones to criminal gangs gets nine years in

prison - Phantom Secure customers included the Sinaloa carter and

the Hells Angels biker gang.

https://www.zdnet.com/article/ceo-who-sold-encrypted-phones-to-criminal-gangs-gets-nine-years-in-prison/

The Marines' Top General Talks About A Changing Corps - Why did Bob

Neller join the Marines? "I needed a job," the top Marine officer

says nonchalantly. He went to Officer Candidate School the summer

before his senior year at the University of Virginia with the

intention of then going to law school.

https://www.npr.org/2019/06/04/729300525/the-marines-top-general-talks-about-a-changing-corps

Huawei ban revoked by science publisher IEEE - The Institute of

Electrical and Electronics Engineers on Sunday reversed restrictions

it had slapped on Huawei last week, letting the Chinese company's

scientists review its papers once again.

https://www.cnet.com/news/huawei-ban-revoked-by-science-publisher-ieee/

Organizations still struggle to manage vulnerability patches, report

- Nearly 27 percent of organizations worldwide have been breached as

a result of an unpatched vulnerability, according to Vulnerability

Management Survey.

https://www.scmagazine.com/home/security-news/vulnerabilities/organizations-still-struggle-to-manage-vulnerability-patches-report/

Premera Blue Cross reaches proposed $72M settlement with 2014 breach

victims - Health insurance company Premera Blue Cross has agreed to

a $72 million proposed settlement that would resolve a contentious

class-action lawsuit stemming from a 2014 data breach affecting

roughly 10.6 million people.

https://www.scmagazine.com/home/security-news/legal-security-news/premera-blue-cross-reaches-proposed-72m-settlement-with-2014-breach-victims/

ATTACKS, INTRUSIONS, DATA THEFT & LOSS

FYI

-

Nonprofit People Inc. info exposed after two

employee email accounts breached - Nonprofit People Inc. has

notified nearly 1,000 of its current and former clients that

personal information was exposed after email accounts of two

employees had been breached.

https://www.scmagazine.com/home/security-news/data-breach/nonprofit-people-inc-info-exposed-after-two-employee-email-accounts-breached/

POS malware swipes payment info from Checkers and Rally’s

restaurants - Just over 100 Checkers and Rally’s fast food joints

and their customers were victimized by a long-running point-of-sale

malware campaign that stole payment card information from purchases

taking place as far back as December 2015, Checkers Drive-In

Restaurants announced in an online breach notification yesterday.

https://www.scmagazine.com/home/security-news/cybercrime/pos-malware-swipes-payment-info-from-checkers-and-rallys-restaurants/

Theta360 leak exposes 11 million photos, user data - An open

database exposed at least 11 million photographs after the Theta360

photo sharing system run by Ricoh was breached.

https://www.scmagazine.com/home/security-news/privacy-compliance/theta360-leak-exposes-11-million-photos-user-data/

Nonprofit People Inc. info exposed after two employee email accounts

breached - Nonprofit People Inc. has notified nearly 1,000 of its

current and former clients that personal information was exposed

after email accounts of two employees had been breached.

https://www.scmagazine.com/home/security-news/data-breach/nonprofit-people-inc-info-exposed-after-two-employee-email-accounts-breached/

Breach of bill collection agency may affect 11.9 million Quest

Diagnostics patients - Quest Diagnostics today disclosed that

roughly 11.9 million patients who sought medical testing through its

clinical labs may be affected by the breach of a third-party bill

collection agency.

https://www.scmagazine.com/home/security-news/breach-of-bill-collection-agency-may-affect-11-9-million-quest-diagnostics-patients/

ANU data breach exposes 19 years of staff and student data -

Australian National University revealed news of a data breach today

that took place in late 2018 compromising the PII of more than

200,000 employees and students who were associated with the school

for the last 19 years.

https://www.scmagazine.com/home/security-news/data-breach/anu-data-breach-exposes-19-years-of-staff-and-student-data/

UChicago Medicine secures database after publicly exposing info on

donors and patients - The University of Chicago Medicine scrambled

to secure a database containing information on patients as well as

existing and potential financial donors, after a researcher

discovered that a misconfiguration left nearly 1.68 million records

exposed to the public.

https://www.scmagazine.com/home/security-news/data-breach/uchicago-medicine-secures-database-after-publicly-exposing-info-on-donors-and-patients/

Return to the top

of the newsletter

WEB SITE COMPLIANCE -

We continue covering some of the

issues discussed in the "Risk Management Principles for Electronic

Banking" published by the Basel Committee on Bank Supervision.

Board and Management Oversight

- Principle 8: Banks

should ensure that appropriate measures are in place to protect the

data integrity of e-banking transactions, records and information.

Data integrity refers to the assurance that information that is

in-transit or in storage is not altered without authorization.

Failure to maintain the data integrity of transactions, records and

information can expose banks to financial losses as well as to

substantial legal and reputational risk.

The inherent nature of straight-through processes for e-banking

may make programming errors or fraudulent activities more difficult

to detect at an early stage. Therefore, it is important that banks

implement straight-through processing in a manner that ensures

safety and soundness and data integrity.

As e-banking is transacted over public networks, transactions are

exposed to the added threat of data corruption, fraud and the

tampering of records. Accordingly, banks should ensure that

appropriate measures are in place to ascertain the accuracy,

completeness and reliability of e-banking transactions, records and

information that is either transmitted over Internet, resident on

internal bank databases, or transmitted/stored by third-party

service providers on behalf of the bank. Common practices used to

maintain data integrity within an e-banking environment include the

following:

1) E-banking transactions should be conducted in a manner that

makes them highly resistant to tampering throughout the entire

process.

2) E-banking records should be stored, accessed and modified in

a manner that makes them highly resistant to tampering.

3) E-banking transaction and record-keeping processes should be

designed in a manner as to make it virtually impossible to

circumvent detection of unauthorized changes.

4) Adequate change control policies, including monitoring and

testing procedures, should be in place to protect against any

e-banking system changes that may erroneously or unintentionally

compromise controls or data reliability.

5) Any tampering with e-banking transactions or records should

be detected by transaction processing, monitoring and record keeping

functions.

Return to

the top of the newsletter

FFIEC IT SECURITY -

We continue our series on the FFIEC

interagency Information Security Booklet.

SECURITY CONTROLS -

IMPLEMENTATION -

NETWORK ACCESS

Firewall Policy (Part 3 of 3)

Financial institutions can reduce their vulnerability to these

attacks somewhat through network configuration and design, sound

implementation of its firewall architecture that includes multiple

filter points, active firewall monitoring and management, and

integrated intrusion detection. In most cases, additional access

controls within the operating system or application will provide an

additional means of defense.

Given the importance of firewalls as a means of access control,

good practices include:

! Hardening the firewall by removing all unnecessary services and

appropriately patching, enhancing, and maintaining all software on

the firewall unit;

! Restricting network mapping capabilities through the firewall,

primarily by blocking inbound ICMP traffic;

! Using a ruleset that disallows all traffic that is not

specifically allowed;

! Using NAT and split DNS (domain name service) to hide internal

system names and addresses from external networks (split DNS uses

two domain name servers, one to communicate outside the network, and

the other to offer services inside the network);

! Using proxy connections for outbound HTTP connections;

! Filtering malicious code;

! Backing up firewalls to internal media, and not backing up the

firewall to servers on protected networks;

! Logging activity, with daily administrator review;

! Using intrusion detection devices to monitor actions on the

firewall and to monitor communications allowed through the firewall;

! Administering the firewall using encrypted communications and

strong authentication, only accessing the firewall from secure

devices, and monitoring all administrative access;

! Limiting administrative access to few individuals; and

! Making changes only through well - administered change control

procedures.

Return to the top of

the newsletter

NATIONAL INSTITUTE OF STANDARDS

AND TECHNOLOGY -

We

continue the series on the National Institute of Standards and

Technology (NIST) Handbook.

Chapter 20 -

ASSESSING AND MITIGATING THE RISKS TO A HYPOTHETICAL COMPUTER SYSTEM

(HGA)20.3.5

Network-Related Threats

Most of the human

threats of concern to HGA originate from insiders. Nevertheless, HGA

also recognizes the need to protect its assets from outsiders. Such

attacks may serve many different purposes and pose a broad spectrum

of risks, including unauthorized disclosure or modification of

information, unauthorized use of services and assets, or

unauthorized denial of services.

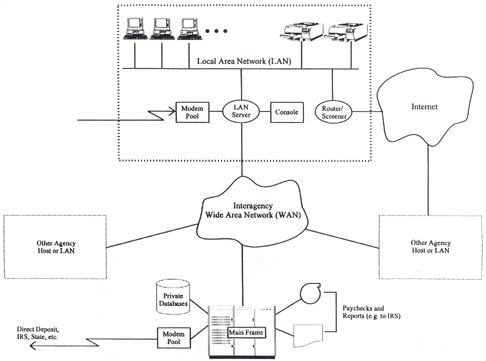

As shown in the figure

below, HGA's systems are connected to the three external networks:

(1) the Internet, (2) the Interagency WAN, and (3) the

public-switched (telephone) network. Although these networks are a

source of security risks, connectivity with them is essential to

HGA's mission and to the productivity of its employees; connectivity

cannot be terminated simply because of security risks.

In each of the past few

years before establishing its current set of network safeguards, HGA

had detected several attempts by outsiders to penetrate its systems.

Most, but not all of these, have come from the Internet, and those

that succeeded did so by learning or guessing user account

passwords. In two cases, the attacker deleted or corrupted

significant amounts of data, most of which were later restored from

backup files. In most cases, HGA could detect no ill effects of the

attack, but concluded that the attacker may have browsed through

some files. HGA also conceded that its systems did not have audit

logging capabilities sufficient to track an attacker's activities.

Hence, for most of these attacks, HGA could not accurately gauge the

extent of penetration.

In one case, an

attacker made use of a bug in an e-mail utility and succeeded in

acquiring System Administrator privileges on the server--a

significant breach. HGA found no evidence that the attacker

attempted to exploit these privileges before being discovered two

days later. When the attack was detected, COG immediately contacted

the HGA's Incident Handling Team, and was told that a bug fix had

been distributed by the server vendor several months earlier. To its

embarrassment, COG discovered that it had already received the fix,

which it then promptly installed. It now believes that no subsequent

attacks of the same nature have succeeded.

Although HGA has no

evidence that it has been significantly harmed to date by attacks

via external networks, it believes that these attacks have great

potential to inflict damage. HGA's management considers itself lucky

that such attacks have not harmed HGA's reputation and the

confidence of the citizens its serves. It also believes the

likelihood of such attacks via external networks will increase in

the future.

|